Bursa Malaysia Shariah List: 20 Additions, 15 Deletion

EPF expects to see 1.5 mn of its 6.7 mn depositors migrate their retirement savings to a new Shariah compliant plan within the first year of its projected launch in January 2017.

● The new Shariah list , effective 27 May 2016, has 669 Shariahcompliant stocks, 74% compliant—20 stocks were added while 15 were deleted.

● Shariah AUM in Malaysia amounted to RM101 bn as of Mar-16 (35% in equities), up by 16% YoY. The Shariah AUM growth surpassed the 1% growth registered by total Malaysian AUM (exGLiCs) (RM669 bn).

● Bigger cap stocks removed from the Shariah list—Bumi Armada, Sunway Construction, Hume Industries and Kian Joo. Bigger cap names which are now Shariah compliant include Hong Leong Industries, Star Media and Amway.

● EPF expects to see 1.5 mn of its 6.7 mn depositors migrate their retirement savings to a new Shariah-compliant plan in 2017. This would account for RM100 bn in pensions savings. Thus, Shariah AUM could easily double from its current RM101 bn.

Figure 1: Shariah AUM in Malaysia has grown 16% YoY to RM101bn

The new Shariah-compliant list is effective 27 May 2016

A new list of Malaysian equities that qualify for Islamic investment, compiled by the SC, takes effect 27 May 2016. The new list now has 669 Shariah-compliant stocks, out of the total 905 Bursa-listed stocks (74% compliant)—20 stocks were added while 15 were deleted.

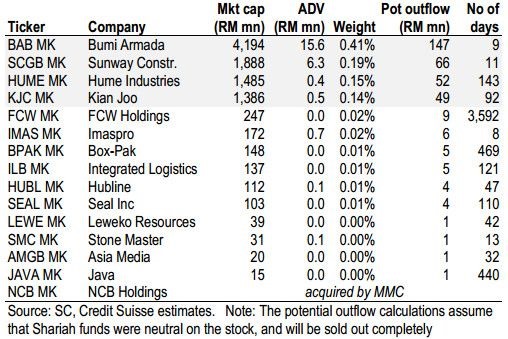

Figure 2: The 15 companies which were removed from the Shariah list

The Industrials, Telco, Plantation and Utilities sectors have the biggest weightings, accounting for 23%, 15%, 15% and 13%, respectively, of the Shariah total weightings.

Shariah AUM in Malaysia amounted to RM101 bn as of Mar-16 (35% in equities), up by 16% YoY. The Shariah AUM growth surpassed the 1% growth registered by total Malaysian AUM (ex-GLiCs) (RM669 bn).

We highlight in Figure 2, the stocks removed from the Shariah list— the bigger cap names are Bumi Armada, Sunway Construction, Hume Industries & Kian Joo.

Figure 3: The 20 companies which were added to the Shariah list

Figure 3 lists the stocks added to the Shariah list—the bigger cap names are Hong Leong Industries, Star Media & Amway.Sunway Construction was added in Nov2015 and now removed, after six months. Star was removed in Nov2015 and now added back.

EPF could double the Shariah AUM

Employees Provident Fund expects to see 1.5 mn of its 6.7 mn depositors migrate their retirement savings to a new Shariah compliant plan within the first year of its projected launch in January 2017. This would account for RM100 bn in pensions savings, EPF CEO Shahril said in Feb 2016. Thus, Shariah AUM could easily double from its current RM101 bn.

Food for thought:

Does this mean that Shariah heavyweight sectors such as Industries, Telco, Utilities and Plantations will command significant premiums, as Shariah funds become more dominant?

The bulk of the banking sector is non-Shariah. Does this mean that the banking sector in Malaysia could derate?

source: Credit Suisse 30/05/2016