Malaysia Market Strategy: Sell in May And Go Away?

Sell in May And Go Away?

● We do not normally subscribe to blindly "selling in May and going away" but this May will be an especially difficult one for Malaysia: (1) Malaysia’s weightings in EM will fall by 8% to 3.09%, effective close of 31 May, the largest fall in SEA. We estimate S$399 mn (net) will exit Malaysia. (2) the 1Q16 result season has startely poorly— revenue is down 3.2% YoY and 9.5% QoQ. Net profits have fallen 11.6% YoY and 16.1% QoQ, while margins have been squeezed - 1.1 pp YoY and -0.9 pp QoQ to 11.7%. There is more downside.

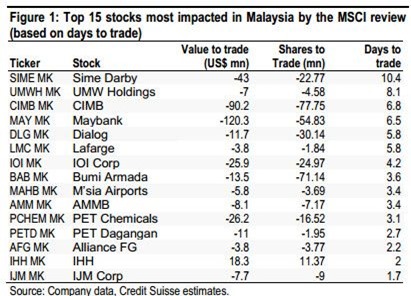

● The five biggest downweights are SIME -22.8 mn shares (10.4 days to trade); UMWH -4.6 mn (8.1); CIMB -77.8 mn (6.8); MAY -54.8 mn (6.5) and DLG -30.1 mn (6.0). Food for thought: in 1996, MSCI Malaysia weighting was 22% versus 3% on 1 June.

● Biggest upweights are IHH +11.4 mn shares (2.0 days to trade); BAT +0.5 mn (0.7) and Public Bank +0.9 mn (0.7).

● Key Underperforms in Malaysia: Maxis, Maybank, Tenaga and IOIP. Key themes in Malaysia are as follows: (1) Plantations (sector pick:

GENP); (2) Construction (GAM, IJM); and (3) Tourism (AAX, GENT).

Sell in May and go away?

We do not normally subscribe to blindly "selling in May and going away" but this May will be an especially difficult one for Malaysia.

Malaysia’s weightings in EM fell to 3.09% from 3.36%, effective close of 31 May. We estimate a net of S$399 mn will exit Malaysia. The five biggest downweights are: SIME -22.8 mn shares (10.4 days to trade); UMWH -4.6 mn (8.1); CIMB -77.8 mn (6.8); MAY -54.8 mn (6.5) and DLG -30.1 mn (6.0). The biggest upweights are: IHH +11.4 mn shares (2.0 days to trade); BAT +0.5 mn (0.7) and Public Bank +0.9 mn (0.7). We expect the big caps to lag the small caps in the short term.

A poor start to the 1Q16 results season

From the companies that have reported so far, 1Q16 revenue is down 3.2% YoY and 9.5% QoQ. Net profits have fallen 11.6% YoY and 16.1% QoQ, while net profit margins have been squeezed -1.1 pp YoY and -0.9 pp QoQ to 11.7%. We believe there is more downside to consensus 2016 EPS estimates, and earnings momentum remain negative.

Food for thought

For those who lived through the hey-days of the early and mid-1990s,

when MSCI Malaysia made up 22.0% of the index, it is heartwrenching to see MSCI Malaysia dwindling to just 3.09% weighting.

MSCI Malaysia will get diluted further when China A-shares are

eventually included into the MSCI indices.

Key UPs in Malaysia: Maxis, Maybank, Tenaga and IOIP

Our key themes in Malaysia are as follows: (1) Plantations (Sector pick: GENP); (2) Construction (GAM, IJM); (3) Tourism (AAX, GENT).

source: Credit Suisse – 23/05/2016