Malaysia Market - Street Earnings Estimates Reduced Post-GE 14

Malaysia Market Strategy

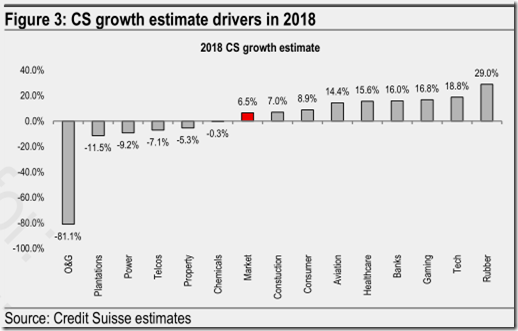

● Street earnings estimates for the market have been downgraded since GE 14. Over the last three months, street's net profit estimate for the market has been reduced by 1.6%. As a result, the net profit growth forecast for the market has been trimmed to 7.0% for 2018, compared to ~9% prior to GE 14.

● With the exception of aviation, petrochemical, and banks sectors, street net profit estimates for other sectors have been cut. Oil+gas (mostly for company specific reasons), property, construction healthcare, and telecommunication sectors have suffered the biggest reduction in street net profit estimates.

● Sectors where we believe there is scope for upgrades in street's net profit estimates include property, consumer, and banks; the scope for an upgrade is also likely for SIME. Sectors that offer the highest projected net profit growth (ranked in descending order) are rubber, technology, gaming, and banks.

● Our preferred picks for the sectors with scope for earnings upgrades—banks (Maybank, CIMB, Alliance), property (Mah Sing, SP Setia), consumer (BAT, Astro, Padini), Sime Darby

Street earnings expectations reduced post GE 14

Street earnings estimates for the market have been downgraded since GE 14. Over the last three months, the street's net profit estimate for the market has been reduced by 1.6%. With the exception of the aviation, petrochemical, and banks sectors, street net profit estimates for other sectors have been cut. Oil+gas (mostly for company specific reasons), property, construction, healthcare, and telecommunication sectors have suffered the biggest reduction in estimates.

Street net profit growth for 2018 trimmed to 7% Street's net profit growth forecast for the market has been trimmed to 7.0% for 2018, compared to ~9% prior to GE 14. Sectors that offer the highest projected net profit growth (ranked in descending order) are rubber, technology, gaming, and banks.

Which sectors could potentially deliver positive earnings surprises?

Sectors where we believe there is scope for upgrades in street's net profit estimates include property, consumer, and banks; the scope for upgrade is also likely for SIME.

source: Credit Suisse – 13/07/2018