Malaysia’s Post-GE14: Besieged Construction-related Stocks

Construction and highway concession related stocks have capitulated with most stocks within our coverage plunging 20-44% last week (post general election), besieged by concerns - likely cancellation/deferment of some mega projects, potential contract renegotiation of ongoing mega projects, and toll road concessionaires being compromised. While investors have become overly-bearish and we foresee shares rebounding from historically low valuation levels, we downgrade the construction sector to MARKET WEIGHT for its lack of growth drivers.

WHAT’S NEW

• Construction sector capitulates... Most construction stocks within our coverage plunged 20-44% last week (falling 22-55% from year-ago levels with exception of Kerjaya and SunCon – see RHS table), as the new Pakatan Harapan-led Malaysian government swiftly followed up to fulfil its election manifesto to review the country’s mega projects and toll charges. Signs of the sector’s capitulation include significant ‘collateral damage’ on SunCon (down 15.5% since elections), which does not significantly depend on mega projects, toll road operator Llitrak’s 34% plunge and CMS’ limit down last Friday. CMS’ fall was partly due to some calls for the ultimate controlling shareholder (ex-Sarawak chief minister) to be investigated for past corruption practices. In response, CMS issued a statement to emphasise its board’s independence from the controlling shareholder since 2006, balance provided by high institutional ownership, recognition for its sustainability and governance that resulted in its inclusion in FTSE4Good Bursa Malaysia index.

• …as the new government reviews mega projects and toll charges on expressways. Recall that Pakatan Harapan (PH) promised to abolish toll collections and review all mega projects in the country. Last week, a meeting was held between the Council of Elders and highway operator stakeholders, and former finance minister Daim Zainuddin, who heads the council, is expected to announce a decision on toll charges as early as this week.

• Sense to prevail. While some mega projects may be cancelled, deferred or renegotiated (East Coast Rail Link (ECRL) bears the highest risk, while High-Speed Railway (HSR) is rumoured to be also deferred), the market’s misgivings of contract renegotiation for all ongoing mega contracts and expropriation of tolled highways at well below fair valuations are too pessimistic. Market is clearly ignoring Prime Minister’s Dr. Mahathir’s declaration that the new administration would continue to be friendly to the capital market, and the return of the rule of law.

• Trough valuations indicate oversold situation, but sector’s upside is limited by the lack of rerating catalyst. Our worst-case valuation scenario suggests that most construction-related stocks are oversold. However, the new reality also limits the recovery of companies which are dependent on government mega projects.

ACTION

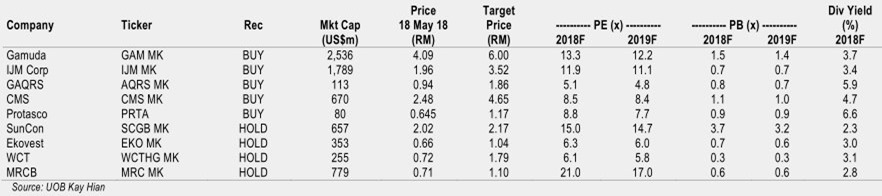

• Downgrade construction sector to MARKET WEIGHT. We retain our BUY calls for Gamuda, CMS, Gabungan AQRS and Protasco. Values have emerged in HOLD-rated WCT, which now trades at 0.4x P/NTA after its 44% share price fall last week, and MRCB, which could benefit from the government’s expropriation of tolled expressways. However, target prices would have to be adjusted down depending on government decisions, and as the sector lacks major growth drivers. Our OVERWEIGHT call on the Building Material sector is under review.

MALAYSIA’S CONSTRUCTION AND EXPRESSWAY RELATED COMPANIES

ESSENTIALS/STOCK IMPACT

• Sum of all fears. Fears have mounted on the government-dependent construction-related sector/stocks, in view of PH’s socialistic manifesto to abolish toll collections and review all mega projects in the country. In particular, investors are concerned that the government will: a) cancel or defer already-approved mega projects, b) review terms of existing mega project awards secured especially via non-merit basis, c) cease toll charges, which implies the need to expropriate expressways from existing concessionaires, and d) review federal and state road maintenance concessions. There is fear that the expropriation values could be sub-par, given the enormous financials required that could strain the federal government’s already- tight finances. Assuming an expropriation scenario that excludes the north-south highway, the cost of repaying the concessionaires’ bondholders would amount to RM21b (equivalent to 1.5% of 2017 nominal GDP), before compensating the concessionaires.

• Mega projects at risk of being cancelled include ECRL and HSR, while MRT3 award and implementation could be deferred. Nevertheless, we reckon Pan Borneo highways projects will proceed (already underway in Sarawak), albeit delayed in Sabah.

• Government expected to be mindful of repeating the incident of IPP windfall taxes in Jun 08. Reneging on past contracts to significantly compromise the toll road concessionaires could dampen the capital markets, as in the situation in Jun 08 when the government imposed a hefty windfall levy on independent power producers (IPP) (30% windfall tax on return on assets for contributing towards the higher fuel costs) in ceding to populist demand to punish IPPs for securing fat power producing agreements since the 1990s. The windfall tax was reduced to a much more acceptable one-off payment to the government in Sep 08, but by then, appreciable damage had been done on the capital market as bonds yields (by over 50 bp) and risk premium rose. IPPs in particular, lost at least RM10b worth of market value at one stage, just based on the fall of the IPPs’ traded stocks and bonds.

• Our worst-case assessment. Our worst-case scenario for affected stocks (see table below), which assume the freezing of toll rates, cancellation of ECRL and HSR contracts, and lower PE multiples for construction segment (12x), still demonstrate that there is upside from current levels.

WORST-CASE SCENARIO ASSESSMENT

• Meanwhile, we cut MRCB’s SOTP by 29% to RM4.1b as our previous assumption of its EDL highway had been overly bullish. Nevertheless, MRCB may benefit from an expropriation situation (it has stopped tolling for the Eastern Dispersal Link since the previous government suspended toll charges for some tolls in Budget 2018), given that EDL is loss-making and assuming that the government would at least repay EDL lenders.

• Review of road maintenance unlikely to take place. While share prices of road maintenance concessionaires Protasco and CMS have also plunged, these companies are likely to renew their respective contract awards given their competitiveness. For example, Protasco won tenders from both Barisan Nasional and PKR-controlled states (Perak and Selangor), while CMS’ competitiveness lies in its RM100m state-of-the-art equipment and experienced staff.

CATALYSTS

• Fears of wide-ranging government reviews (see below) only partially materialising.

RISKS

• New government’s review ranging from mega projects awards, to cancellation/deferment of previously-announced new mega projects, and ceasing tolling and expropriating expressways at below market values.

source: UOBKayHian – 21/05/2018