Malaysia - Spotting Trading Opportunities

The significant selldown in Bursa last week, in tandem with the meltdown of global equity bourses, creates good opportunities in selected BUY-rated stocks. We foresee a significant recovery in the FBMKLCI as we near Malaysia’s GE (GE14, expected in 2Q18). Our favourite rebound plays include large-caps Genting Bhd, CIMB, YTL Power and BAT, and small/mid caps Gabungan AQRS, Ann Joo, Yong Tai and Protasco.

WHAT’S NEW

• Selldown ahead expected, but market rebound foreseen. We foresee market stability following last week’s unexpected surge in market volality (VIX), which caused the S&P500 to correct by over 10% (before last Friday’s partial recovery). We had earlier expected global markets to recalibrate equity valuations only in 2H18 amid rising interest rates. Nevertheless, we expect significant recoveries in global equity markets driven by economic growth and a still-moderate interest rate environment (until the 10-year US treasury bond breaches 3.0%). The FBMKLCI should also firm up as we near the country’s general election (expected in 2Q18).

• Domestic flows to support recovery. Foreign equity flows partially reversed by RM1.2b in Feb 18, following a strong start in Jan 18 (+RM3.4b). Inflow may be reduced by concerns of rising risk aversion in emerging markets (as rising US long-term interest rates to the psychological 3% level imply higher re-allocation for fixed income and higher required returns in emerging markets). Recent feedback from various investors from Singapore and Hong Kong continue to imply a continuing neutral outlook for the FBMKLCI. Nevertheless, our survey of local funds suggest that many funds are not yet fully invested, and should support the FBMKLCI’s recovery when sentiment picks up ahead of GE14.

ACTION

• No change to our view for FBMKLCI to reach 1,850-1,900 ahead of elections, before ending the year at 1,830. This values the market at +0.6SD above historical average PE.

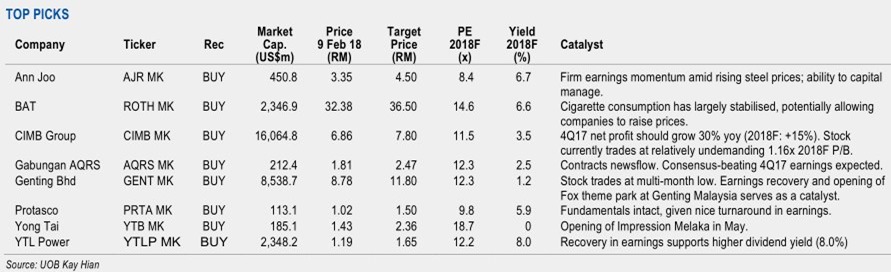

• A handful of timely opportunities identified. From the list of the recently sold-down stocks (see a more comprehensive list below), we identify trading opportunities in BUY- rated large caps Genting Bhd, CIMB, YTL Power and BAT, and small-mid caps Ann Joo, Gabungan AQRS, Protasco and Yong Tai. These companies feature reasonably compelling re-rating catalysts in 1H18 (see table below).

• We advise paring down on overvalued sectors or stocks on market rebound. We UNDERWEIGHT the rubber gloves sector. Elsewhere, we have SELL calls on Sapura Energy and UMW Holdings.

zsource: UOBKayHian – 12/02/2018