Plantation Sector: 2017 Price Outlook at the 12th IPOC

Last week, we attended the 12 th Indonesian Palm Oil Conference and 2017 Price Outlook (IPOC). Key takeaway is that CPO price outlook is expected to remain volatile for 2017, ranging from RM2,000 to RM3,300 per tonne. This is backed by factors such as i) weakening of MYR, ii) growing biodiesel markets, iii) recovery effect of El Nino and iv) premiums between CPO and soybean oil as well as CPO and crude oil. Note that our average CPO price estimate for CY17 is maintained at RM2,700/tonne and we retain our Underweight stance on the plantation sector.

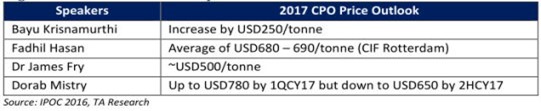

IPOC Speakers on 2017 CPO Price Outlook

Bayu Krisnamurthi, Indonesia Estate-Crop Fund for Palm Oil (IECF)

Krisnamurthi has shared that with the implementation of B20 biodiesel mandate i Indonesia since January 2016, FFB price had increased by 60.9% YTD to Rp1,850/kg. In addition, it had generated forex savings of USD1.1bn from dependence ofossil fuels. This is premised upon Indonesia’s total usage of 3mn kilolitre of biodiesel in 2016. For 2017, Indonesia is expected to use 18% of the total estimated CPO production of 35.3mn tonnes for biodiesel, thus creating a new sustainable demand for the palm oil industry. This is expected to lift CPO price by USD250/tonne in 2017 from current CPO price levels.

Fadhil Hasan, Indonesia Palm Oil Association (GAPKI)

Hasan believes that the CPO price for 2017 is expected to trade in between USD680 and 690/tonne. He expects that 2017 CPO price will trend considerably higher than in 2016 as: i) growth of world’s palm oil consumption (5.3%) is trending higher as compared to growth in palm oil production (4.0%) over the past 5 years; ii) continued slowdown in world economic growth; iii) narrowing gap of CPO and soybean oil prices; and iv) implementation of biodiesel programs by various countries; i.e. B20 in Indonesia and B10 in Malaysia. CPO price is expected to be relatively stable at current level until the end of the year. Then, it will start picking up in 1HCY17 due to growing demands. However, the price is expected to decline as we enter into the peak production season in 2HCY17. Note that Hasan expects that Indonesia’s CPO production to total to 32 – 33mn tonnes in 2017.

Dr James Fry, LMC International Ltd

Dr Fry started off his talk with the impact of the Indonesia Moratorium Policy whereby the policy will only have a long-term negative effect on palm oil output. Currently, output mainly affected by the weather, i.e.: El Nino/La Nina. The world’s CPO tput in 2016 is expected to be around 6mn tonnes, lower than 2015. However, 2017 should experience a sharp rebound in output y 3mn tonnes. Furthermore, Dr Fry estimated that CPO price will continue to trade higher by 1HCY17 due to weakening of Ringgit and current low levels of palm oil stocks. However, palm oil price is expected to stabilise at around USD500/tonne in 2HCY17 due to Indonesia Estate-Crop Fund for Palm Oil’s (BPDP) allocation of biodiesel subsidies for 4.4mn tonnes of CPO and improvement in palm oil stocks in Indonesia and

Dorab Mistry, Godrej International Ltd

Factors which could stabilise the CPO price include: 1) no major trade disrupons by the new Trump administration to cause brent crude oil price fluctuation, 2) India Biting Point of Rs60,000/tonne (equivalent to RM3,900/tonne) where CPO price is not able to surpass this amount as palm oil demand in India is highly price elastic. Overall Dorab estimates that the CPO price to trade as high as USD780/tonne (RM3,300/tonne) in the 1QFY17 on the back of i) implementation of new biodiesel mandates in Indonesia, Malaysia and the US, ii) 2017 may be election year in Malaysia which could further add to the volatility of CPO price and iii) weakening of Ringgit to USD. By 2HCY17, the price is expected to go to as low as USD650/tonne (RM2,400/tonne) as production starts to pick up. However, given the inelastic nature of palm lauric as countries in the EU or US uses it for cosmetics and food, this could still keep the prices high in 2017.

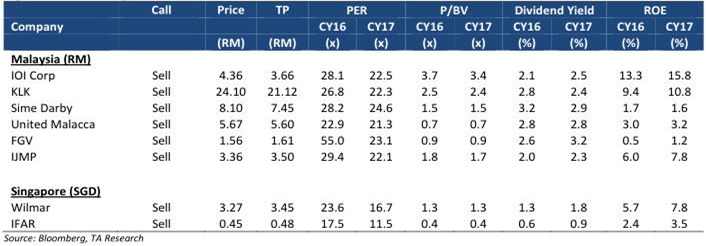

CPO Price Outlook Comparison Table

Maintain Underweight

Despite the expected high CPO price in 1H17, there is no change to our sector’s earnings as companies may face challenges in keeping up with demand i.e. sustainability issues and managing the increasing costs of production, which reduces margins. Maintain estimate of 2017 CPO price at RM2,700/tonne. We reiterate our Underweight recommendation for the plantation sector. Maintain Sell on IOI, KLK, Sime Darby, FGV, IJMP, United Malacca, Wilmar and IFAR, due to pricey valuations.

Peers’ Comparison Table

source: TA Securities – 28/11/16