Bursa Malaysia’s 2Q16 Results Preview

Not expecting major surprises in earnings

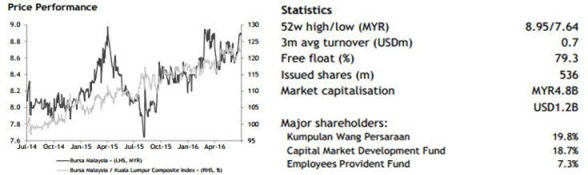

We project MYR50m 2Q16 net profit, about flattish YoY (+2.0%) and QoQ (+1.1%), which would lift 1H16 net profit to MYR100m (+4.0% YoY). We

make no change to our earnings forecasts and MYR9.05 TP which pegs on a 23x 2016 PER, in line with peers. Bursa offers a decent 4.1% normal

yield with the ability to pay more. Maintain HOLD.

We project MYR50m 2Q16 net profit, about flattish YoY (+2.0%) and QoQ (+1.1%), which would lift 1H16 net profit to MYR100m (+4.0% YoY). We

make no change to our earnings forecasts and MYR9.05 TP which pegs on a 23x 2016 PER, in line with peers. Bursa offers a decent 4.1% normal

yield with the ability to pay more. Maintain HOLD.

Equities almost flattish, but derivatives saw a jump

Equities ADV averaged MYR2.0b in 2Q16 (-0.3% YoY, -3.5% QoQ), and we estimate velocity (trading value/market valuation) was at 30%, little changed YoY and QoQ. Derivatives volume was however strong at 3.88m in 2Q16 (+21.7% YoY, +11.8% QoQ) driven by FCPO, at 82% of total volume. These 2Q16 numbers led 1H16 equities ADV to MYR2.03b (-2.6% YoY) and derivatives volume to 7.35m (+9.0% YoY). Equities and derivatives contributed 48%/18% to operating revenue in FY15.

No change to our earnings forecasts

At an anticipated MYR100m 1H16 net profit, this would make up 48% of our full-year forecast. Our current forecasts incorporate MYR2.1b equities ADV and a 15% YoY growth in derivatives volume and admitedly, 1H16 data was a marginal shortfall. We maintain our earnings forecasts for now. Bursa will release its 1H16 results next Monday, 25 Jul.

Decent yield, and can be better

We think that Bursa may announce a 17sen DPS, its 1st interim for FY16, during its 1H16 results release. This assumes 91% DPR on e.MYR100m 1H16 net profit. For the full year, we forecast 36.5sen DPS which gives 4.1% yield. Unencumbered cash stood at MYR338m (63sen/shr) end-Mar 2016 and after deducting for FY15 final dividend of 18sen/shr (paid on 18 Apr 2016), the proforma cash balance should remain a sizeable MYR242m

(45sen/shr). Bursa has the ability to pay more. Previous special dividends in FY13 and FY14 was at 20sen/shr each.

source: Maybank IB 22/07/16