Construction–Maiden Large MRT 2 Package Takes Off

■ MRT Corp announces MRT 2’s first big viaduct package award worth RM1.4bn.

■ This kicks off the play on MRT 2, reaffirming our recent findings on award timing.

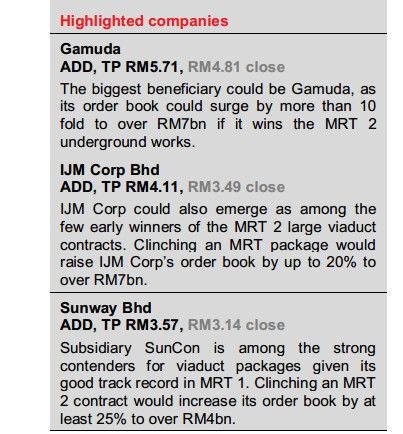

■ Gamuda, IJM Corp and Sunway Construction are the frontrunners for next awards.

First MRT 2 viaduct contract awarded to AZRB

● MRT Corp has awarded the first viaduct work package for the MRT Sungai BulohSerdang-Putrajaya (SSP) Line to AZRB. The work package V202 involves the viaduct guideway and other works for the 4.5km elevated guideway from Persiaran Dagang to Jinjang in KL. The project value is RM1.4bn. AZRB is currently a contractor for MRT 1. This is one of the awards reserved for bumiputera contractors. The bumiputera portion

of works is 45% of total project cost, vs. 50% for the first MRT Line.

Historic moment, says MRT Corp● MRT Corp CEO Datuk Seri Shahril Mokhtar said that this is an historic moment as it signifies that the implementation of the MRT 2 line is truly on its way. He said that successful tenders may not necessarily be the lowest, as the bids also emphasise technical specialties and commercial aspects. In the case of the AZRB win, MRT Corp said its tender was both the lowest for cost, and highest in score for technical specs.

Award structure of MRT 2 revealed

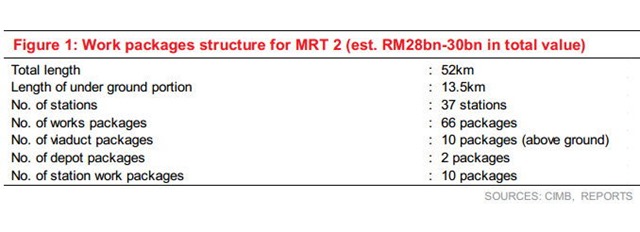

● For the first time, MRT Corp officially revealed the structure of work packages for MRT 2. The 52.2km line includes a 13.5km underground portion. It will have 37 stations, 11 of them underground. There are 66 work packages being tendered to build the SSP Line. They include 10 viaduct guideway packages, one underground works package, two depot work packages, 10 station work packages, and 15 multi-storey park and ride work packages. This is roughly similar to that of MRT 1.

MRT plays should heat up in the short term

● This development is good news. It reconfirms our recent finding about an accelerated award phase for MRT 2 beginning this month. Investors are likely to show more conviction to ride on potential MRT plays in the short term. The next 2-3 packages are likely to be awarded to the bigger players given the higher technical qualifications required. We are optimistic about MMC-Gamuda’s chances of securing the single largest underground package that could be worth as much as RM15bn.

IJM Corp and Sunway are other stronger candidates for now● We believe IJM Corp and Sunway Construction could also emerge as among the few earlier winners of the MRT 2 large viaduct contracts that are similar in size and scale to the one won by AZRB. Clinching an MRT package would raise IJM Corp’s order book by up to 20%, SunCon’s by at least 25%, but the biggest “delta” would be for Gamuda, as its order book could surge by more than 10 fold to over RM7bn if it wins the MRT 2 underground works.

Other beneficiaries a potential play in 2H16

● Most other stocks under our coverage also remain potential MRT plays. However, we expect better visibility in the 2H16 when the MRT 2 awards gain momentum. Potential beneficiaries among contractors under coverage include MRCB, WCT Holdings, Muhibbah Engineering, and Mudajaya. This news reaffirms our Overweight stance on the sector. Our top big-cap pick remains Gamuda, while Muhibbah Engineering

continues to be our preferred mid-cap player.

of works is 45% of total project cost, vs. 50% for the first MRT Line.

Historic moment, says MRT Corp● MRT Corp CEO Datuk Seri Shahril Mokhtar said that this is an historic moment as it signifies that the implementation of the MRT 2 line is truly on its way. He said that successful tenders may not necessarily be the lowest, as the bids also emphasise technical specialties and commercial aspects. In the case of the AZRB win, MRT Corp said its tender was both the lowest for cost, and highest in score for technical specs.

Award structure of MRT 2 revealed

● For the first time, MRT Corp officially revealed the structure of work packages for MRT 2. The 52.2km line includes a 13.5km underground portion. It will have 37 stations, 11 of them underground. There are 66 work packages being tendered to build the SSP Line. They include 10 viaduct guideway packages, one underground works package, two depot work packages, 10 station work packages, and 15 multi-storey park and ride work packages. This is roughly similar to that of MRT 1.

MRT plays should heat up in the short term

● This development is good news. It reconfirms our recent finding about an accelerated award phase for MRT 2 beginning this month. Investors are likely to show more conviction to ride on potential MRT plays in the short term. The next 2-3 packages are likely to be awarded to the bigger players given the higher technical qualifications required. We are optimistic about MMC-Gamuda’s chances of securing the single largest underground package that could be worth as much as RM15bn.

IJM Corp and Sunway are other stronger candidates for now● We believe IJM Corp and Sunway Construction could also emerge as among the few earlier winners of the MRT 2 large viaduct contracts that are similar in size and scale to the one won by AZRB. Clinching an MRT package would raise IJM Corp’s order book by up to 20%, SunCon’s by at least 25%, but the biggest “delta” would be for Gamuda, as its order book could surge by more than 10 fold to over RM7bn if it wins the MRT 2 underground works.

Other beneficiaries a potential play in 2H16

● Most other stocks under our coverage also remain potential MRT plays. However, we expect better visibility in the 2H16 when the MRT 2 awards gain momentum. Potential beneficiaries among contractors under coverage include MRCB, WCT Holdings, Muhibbah Engineering, and Mudajaya. This news reaffirms our Overweight stance on the sector. Our top big-cap pick remains Gamuda, while Muhibbah Engineering

continues to be our preferred mid-cap player.

source: CIMB Research – 25/02/2016