Banking Sector Update - Malaysia

BNM’s Business Loans Growth Tapers Off In Sep 15

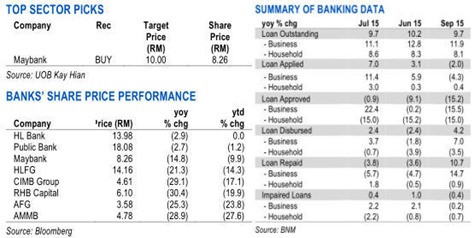

Loans growth moderated as the initial growth traction in business loans begins to

taper off. More importantly, annualised deposit growth of 2% continues to trail loans growth of 8.4% which is likely to keep funding cost elevated. Our top pick in the sector remains Maybank as it is supported by relatively resilient dividend yields and earnings coupled with undemanding valuations. Maintain MARKET WEIGHT.

WHAT’S NEW

• Loans growth moderates. Total loans stood at RM1,424b in Sep 15, +9.7% yoy, a moderation from Aug 15’s +10.2% as the initial robust growth traction in working capital loans has started to taper off, with growth moderating to 15.2% (Aug 15: 15.9%). Annualised loans growth stood at 8.4% for 9M15 vs our full-year 7.2% estimate. As such, both business loans and household loans trended downwards to 8.1% and 11.9% respectively vs Aug 15’s growth of 8.3% and 12.8%.

• Business loans growth in sectors facing cyclical headwinds. The segment of business loans that drove overall growth was fuelled by sectors that continue to face intensifying domestic cyclical consumption headwinds (ie: wholesale retail trade and real estate). As such, we opine that the strength of growth could be a potential sign of some cash flow constraints emanating from a combination of operational bottlenecks from GST refunds and challenging growth environment rather than a reflection of genuine robust business volume demand growth. This renders the strong loans growth unsustainable as reflected in Sep 15’s growth moderation.

• Banks continue to tighten approval standards. Both loans application and approval for Sep 15 contracted 2% and 15% respectively cumulating in loan approval rates declining close to a 9-year low of 43% in Sep 15 vs 9M15 approval rate of 47% and a high of 65% in 2007. The higher rejection rates were largely seen in residential property, non-residential property and purchase of securities where loans approval declined 19%, 35% and 55% respectively for the month of Sep 15.

• Asset quality remained intact. NPL remained relatively benign - absolute NPL declined 0.4% yoy while gross NPL ratio was relatively stable at 1.62%. There was however some slight 3.5% yoy uptick in absolute residential NPL balance but overall NPL ratio remained stable at 1.21% as loans growth remained relatively strong at 12.1%. In terms of broad asset quality trends by segments, business and household absolute NPL balance continued to decline 0.2% and 0.7% respectively.

Banking – Peer Comparison (click to enlarge)

ACTION

• Maintain MARKET WEIGHT. Sector average valuations have declined to 1.23x P/B vs our bottom-up average sector targeted valuation of 1.29x (ROE: 11.4%) implying an upside of only 5%. In assessing a potential stress trough valuation downside risk, we stressed the sector’s asset quality against a backdrop of a potential 100% increase in NPL and 150% increase in net credit cost to 68bp. This would give rise to a de-rating in sector average ROE to 9% and P/B to 0.85x, implying a potential 29% downside in a worst-case scenario. As such, we are retaining our MARKET WEIGHT call on the sector as the risk reward profile remains unfavourable given the potentially more challenging operating environment in 2016.

source: UOBKayHin