Maybank: Target Price RM10.60

BUY RM9.42 KLCI : 1,685.40

Price Target : 12-month RM 10.60

Potential Catalyst: Sustainable high dividend payout and successful

execution of regional expansion

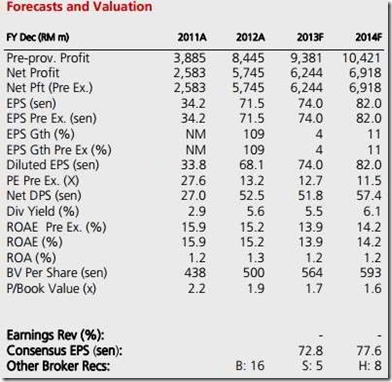

DBSV vs Consensus: Earnings at higher end of consensus

Yield play plus regional uplift

- Expect high dividend payout and dividend reinvestment scheme (DRP) to prevail

- Regional expansion will be re-rating catalyst

- Our top large cap bank pick; MAY offers the highest dividend yields in the sector

High dividends sustainable. Dividend payout ratio should remain high as long as MAY keeps the DRP as its strategic capital management tool. Hence, we expect MAY to continue paying high dividends (we assumed

70% payout vs MAY’s official policy of 40-60%) even with its S108 tax credit fully utilised.

Domestic growth intact; uplift in Indonesian operations will be a bonus. MAY’s plans are to accelerate regionalisation especially in Indonesia, further strengthen its position in Singapore (negotiating with MAS for local incorporation), and transform its Philippines operations (after injecting capital). It targets to increase PBT contribution from international operations from 30% now to 40% by 2015, inclusive of inorganic growth (33% if organic only). BII has a 17% ROE target by 2015 and longer term positive traction at BII could be a re-rating catalyst. Singapore and Indonesian operations currently contribute 13% and 7% of MAY’s pre-tax profit. Non-interest income should continue to track well even in a volatile market, thanks to its strong transaction banking franchise which generates over 50% of fee income that is recurring.

Maintain BUY, RM10.60 TP.MAY remains our top pick as we believe it will continue to pay high dividends and deliver strong earnings. It may still be on a regional acquisition trail, but we do not see risk to its share price

if the acquisition price tag is reasonable. Its DRP has successfully supported its capital ratios and we believe there is low risk of raising capital through other means.

by HwangDBS Vickers