Axiata Group–Target Price Raised

Cashflow On The Mend - Raise to BUY, raise TP to MYR6.70

Upgrade to BUY. We are upgrading Axiata to a BUY for the following reasons. One, the latest results suggest that declining margins that had

been the major negative in previous quarters are stabilising. Two, challenges on the regulatory and currency fronts are well known by the market and already factored into the share price. Three, free cashflow

is improving rapidly, and this could lead to higher dividends from FY13

onward. Axiata has already doubled its interim dividends this time round. Our EV-derived TP is MYR6.70 (MYR5.30 previously).

Above expectations. 2Q12 core net profit rose 12% to MYR717m on a 9% rise in revenue. We have raised our FY12 net profit forecast by 4% to MYR2,718m. Celcom was the best performer (+14%) on growth in all segments. On a normalised basis, Dialog (+59%) and Robi rebounded

(>100%) while XL (-2%) still suffered the impact of its data investment. Forex impact was lesser than 1Q12 as regional currencies stabilised. Interim dividend doubled to 8sen a share (102% DPR).

Margins holding up. Group EBITDA margin improved 1-ppt QoQ to 43.5% in 2Q12, driven by improvements in Malaysia and Bangladesh. Axiata has succeeded in driving back the erosion caused by data via tight cost control. Of note is the growing stabilisation in Indonesian margins as XL is filling up the data network that it has invested heavily in since 2011. While we expect margins to continue to retreat, this will be a function of mix, and overall growth should not be compromised.

Focus on cashflow. While regulatory and currency challenges remain, we think these factors are well-known by the market. One very positive trend is Axiata’s improving cashflow, which should see an accelerating

trend in the next two years as capex is expected to peak this year. This should lead to higher dividend payout potential. FCF jumped 68% YoY to MYR400m in 2Q12, and 1H12 FCF of MYR825m will be more than sufficient to cover the higher interim DPS of 8 sen.

Raise to BUY, raise TP to MYR6.70. Our target price is raised to MYR6.70 on a lower WACC of 7.4% (previously 9%). Axiata recently refinanced its sukuk loans at a lower interest rate, which will lead to cost of debt falling from 7.1% to 3.9%. With more than 10% upside to our new TP, our call on Axiata is now a BUY.

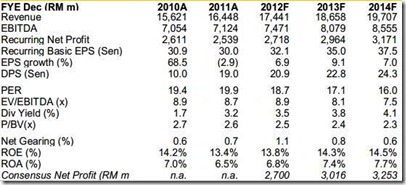

Axiata Group – Summary Earnings Table (click to enlarge)

by Maybank IB