Malaysia Market: The Difficult Year Of 2016

MYR weaker, foreign outflows, negative earnings momentum

● 2016 has been a difficult year for Malaysia: the KLCI fell by 3.0% to 1,641. The Malaysian stock market underperformed the NJA (in USD) by 10% after underperforming in 2015 and 2014. The MYR depreciated 4.3% to close at RM4.4862 against the USD.

● Fortunately, there is some light for commodities: Brent oil +52% to US$56.8, palm oil +42% to RM3,207, rubber +67% to RM8.84.

● Foreign institutions were net sellers of Malaysian equities amounting to RM2.8 bn in 2016, after being net sellers in 2015 (-RM19.3 bn) and 2014 (RM6.6 bn). Earnings momentum was

negative throughout 2016.

● Top performers (CS coverage): AIRX (+100%), AIRA (+78%), PAD (+37%), GENT (9%), MAHB (+8%). Worst: BAB (-41%), KRI (-29%), AXIATA (-26%), TOPG (-21%), and BAT (-21%).

● Fortunately, there is some light for commodities: Brent oil +52% to US$56.8, palm oil +42% to RM3,207, rubber +67% to RM8.84.

● Foreign institutions were net sellers of Malaysian equities amounting to RM2.8 bn in 2016, after being net sellers in 2015 (-RM19.3 bn) and 2014 (RM6.6 bn). Earnings momentum was

negative throughout 2016.

● Top performers (CS coverage): AIRX (+100%), AIRA (+78%), PAD (+37%), GENT (9%), MAHB (+8%). Worst: BAB (-41%), KRI (-29%), AXIATA (-26%), TOPG (-21%), and BAT (-21%).

The difficult year of 2016: Ringgit depreciation

2016 has been a difficult year for Malaysia: the KLCI fell 3.0% to 1,641. The Malaysian stock market underperformed the NJA (in USD) by 10% after underperforming in 2015 and 2014. In short, Malaysia has been a serial underperformer for three consecutive years, driven partly by massive outflows by foreign institutions (outflows of RM6.6 bn, RM19.3 bn and RM2.8 bn in 2014, 2015 and 2016 respectively).

Ringgit has now weakened further to RM4.4862:

The MYR depreciated 4.3% to close at RM4.4862 against the USD (lowest since January 1998) and 6.9% against the JPY but appreciated 15.5% against the GBP. MGS +4.2 bp to 4.228. There is some light for commodities: Brent oil +52% to US$56.8, palm oil +42% to RM3,207/t, rubber (SMR20) +67% to RM8.84/kg.

On the political front, Prime Minister Najib is here to stay. If PM Najib survived the very turbulent 2015 and is still helming Malaysia, then his intention to remain the Prime Minister is clear.

The poor consumer sentiment—shown in the MIER Consumer Sentiment Index and the AC Nielsen Confidence Index—is probably a reflection of unhappiness over the rising cost of living, diminishing affordability, political limbo, corruption and job uncertainty.

The difficult year of 2016: Foreign equity outflows

Foreign institutions were net sellers of Malaysian equities amounting to RM1.0 bn in Dec-2016, absorbed by domestic institutions, which were net buyers amounting to RM0.9 bn.

To sum the year 2016, foreign investors were net sellers of Malaysian equities amounting to RM2.8bn, after being net sellers in 2015 (-RM19.3 bn) and 2014 (RM6.6 bn).Domestic institutions were net buyers of Malaysian equities amounting to RM0.9 bn in Dec-2016 and RM4.2 bn for the entire year of 2016.

Malaysia’s net inflow/ (outflow)

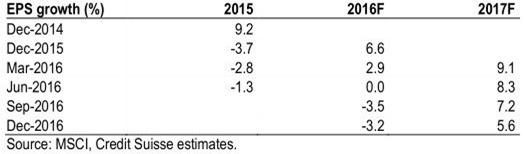

The difficult year of 2016: Negative earnings momentum

Earnings momentum was negative throughout 2016, and the investment community which started 2016 forecasting a 6.6% growth ended the year looking for a 2016 EPS contraction of 3.2%. For now, the market is forecasting that 2017 EPS growth will be +5.6%.

Earnings growth projections for Malaysia:

Source: Credit Suisse Research 4/1/2107