Malaysia’s Plantation Sector: Cooking Oil Subsidy Cuts

According to The Sun Daily, the structure of the Cooking Oil Price Stabilisation Scheme (COSS) is about to change from next month as part of government subsidy rationalisation plan, citing the source from the Malayan Edible Oil Manufacturers' Association (Meoma).

The new structure will be restructured into two phases

The first phase will start from Nov 1 until end of the year and the second phase will begin from next year onwards. In the first phase, the government will only subsidise the 1kg polybag and 5kg bottle cooking oil. The selling price for 1kg polybag will increase from RM2.50 to RM2.90 while the 5kg bottle will increase from RM13.35 to RM15.25. After that, all consumer pack sizes including 500g, 1kg, 2kg, and 3kg bottle will no longer be subsidised by the government and will be selling at open market price.

Neutral Impact to Industry

We believe that the new scheme will have neutral impact on the plantation industry. As we know, Sime Darby and FGV are the only listed cooking oil producers locally. According to Sime Darby, the earnings contribution from the cooking oil division is minimal and most of its cooking oils are selling at wholesale prices. Note that Sime Darby’s mid and downstream operations contributed about RM241.6mn or ~8% of the group’s total operating profit in FY16.

While for FGV, we gather that it has three cooking oil brands in the market namely Saji, Tiara and Tiga Udang under its Fast Moving Consumer Goods (FMCG) sub-cluster, Delima Oil Products Sdn Bhd. Among the three, Saji is the most popular brand and currently available in three package sizes - 1 kg, 2 kg and 5 kg. The FMCG sub-cluster’s bottomline PBT was RM14.3mn or ~4% of the group’s total PBT in FY15.

We believe the demand for cooking oil is unlikely to shrink as it is a necessity for every household. It may have a short-term stocking-up effect now and off-loading later but the overall demand is expected to normalise after that.

Maintain Underweight

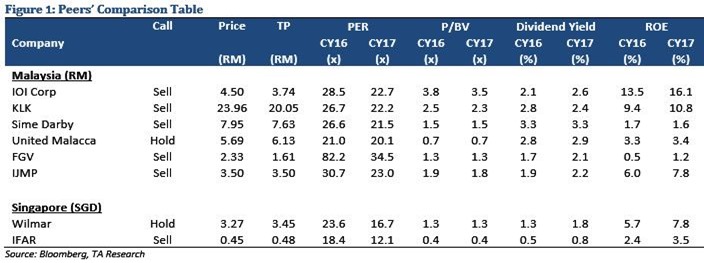

No change to our sector’s earnings. We reiterate our Underweight recommendation for the plantation sector. Maintain Sell on IOI, KLK, Sime Darby, FGV, IJMP and IFAR, due to pricey valuations. Meanwhile, United Malacca, and Wilmar are rated as Hold.

source: TA Securities – 20/10/16