MISC Merging with Bumi Armada?

■ The Star reported at the weekend that MISC is in early-stage discussions to consolidate its FPSO assets with Bumi Armada via a share swap.

■ Pricing aside, this deal may be positive for MISC as the stable-cash flow FPSO business is exactly the sort of segment that MISC wants to grow.

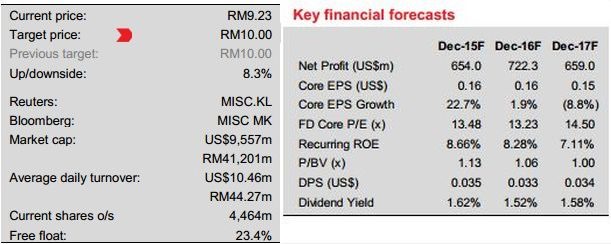

■ We maintain Add, with our target price still based on a 10% discount to SOP.

FPSO merger?

● MISC is in preliminary discussions to merge its FPSO assets with Bumi Armada’s, in exchange for shares in the latter company, The Star reported at the weekend, citing unnamed sources. MISC currently has 12 FPSO assets, while Bumi Armada owns nine FPSOs (six in operation, three under conversion). This deal may or may not have been the initiative of either party, as investment banks regularly propose M&A ideas. Bumi Armada gets into the Petronas fold

● The deal may ultimately be beneficial for both parties, with Bumi Armada coming into the Petronas fold and gaining access to local contract awards, while also gaining access to MISC’s strong balance sheet for future expansion.

MISC can pursue overseas deals jointly

● Meanwhile, MISC may get exposure to Bumi Armada’s current FPSO portfolio, as well as pursue overseas opportunities jointly, utilising Bumi Armada’s wide network of overseas contacts. MISC’s CEO had said in a recent analyst meeting that it was considering potential purchases of charter-backed FPSO assets at attractive prices.

Pricing must be good for it to make sense for MISC

● Bumi Armada’s share price of just RM1 is down from its IPO price of RM1.52 (listed 2011, adjusted for rights) and close to its all-time low, and lower than its book value of RM1.16 at end-2Q15 even after substantial write-downs of its OSV carrying values. At the current price, its shares may be relatively low-risk consideration for MISC. However, whether Usaha Tegas is willing to accept this valuation is another matter.

MISC could own 65% of Bumi Armada

● Bumi Armada currently has 5,866m outstanding shares. We estimate that MISC’s offshore assets are worth RM11bn using DCF as our primary valuation method. A sale of these assets in exchange for shares in Bumi Armada at RM1 each will see MISC own 65% of the latter company. A higher valuation of Bumi Armada’s shares would reduce MISC’s ownership accordingly.

MGO for Bumi Armada unlikely to materialise

● If this deal materialises, we expect MISC to seek exemption from having to make a mandatory general offer for the remaining Bumi Armada shares. However, its free float may decline below the required 25% minimum, which will need to be addressed.

Guarded optimism

● Conceptually, this deal offers an opportunity for MISC to grow its portfolio of stable cashflow assets, in an oil and gas business environment where growth is becoming a scarce commodity. If the pricing is right, this deal could be good for both companies.

Source: CIMB Securities

MISC BERHAD Stock Code: 3816

The principal activities of the Corporation consist of shipowning ship operating and other activities related to shipping services

BUMI ARMADA BHD Stock Code: 5210

The Group is principally involved in the provision of marine transportation and support services engineering and maintenance services for companies operation in the oil and gas industry and related petrochemical sectors.