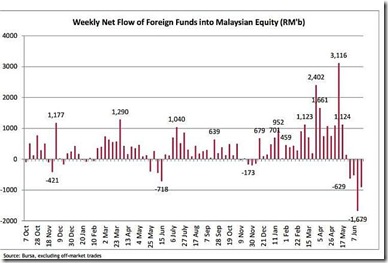

Weekly Net Flow of Foreign Funds into Malaysia

• Foreign selling on Bursa continued for the fourth consecutive week. Foreign funds sold Malaysian equity in the open market (i.e excluding off-market deals) last week amounted to -RM0.91b, much lower compared with -RM1.68b the week before.

• Although on a weekly basis, the size of the outfl ow was lower, the intensity of selling actually increased in the last three days of the week. The week started on a calm note, after the postCrisis record outfl ow the week before. Foreign investors even started buying (on net basis) again on Tuesday. The selling started on Wednesday, ahead of the Fed’s FOMC meeting. It increased on Thursday and by Friday, the net sale amounted to -RM586.9m, one of the heaviest foreign outfl ow

in a single day reported by Bursa.

• Despite the heavy outfl ow in the last four weeks, the overhang of foreign liquidity on Bursa remained a risk in the event of a “disorderly” exodus. This risk has decreased in regional peers, where the worst in foreign withdrawal is likely to be in the past. For example, there has been a complete reversal of foreign fund infl ow for 2013 in Thailand and Indonesia. In contrast only an estimated 32% of the cumulative foreign infl ow to Bursa in 2013 has been withdrawn, leaving +RM14.9b or +USD4.9b outstanding. The corresponding liquidity overhang for foreign fund cumulative inflow from January 2011 is USD10b, about the same as that outstanding in the TIPs markets.

• Foreign participation rate (average daily gross purchase and sale) rose to RM1.4b, the highest in three weeks, indicating increased propensity to sell.

• The retail market remained surprisingly positive. Retail investors snapped up shares last week amounted to +RM117.4m. However, we detect some agitation as participation rate fell to only RM1.1b, the lowest in seven weeks.

• The KLCI would have crumbled if not for the local institutional buying support. Local institutional investors mopped up +RM792m last week.

below: Weekly Net Flow of Foreign Funds into Malaysia (click to enlarge)

ANOTHER TURBULENT WEEK AHEAD...

• We expect another turbulent week ahead in global equity and any rebound will, at best, be transitory. Expect a strong resistance on account of profi t taking.

• Situations around the world after the Fed announced that it is likely to “taper” its bond purchase have been rather chaotic. In China, the announcement has triggered a liquidity crunch at the banks, a situation which will be closely monitored this week. The Shanghai Interbank Offered Rate (SHIBOR) overnight rate, hit a record high of

13.44% last Thursday. Although China has the wherewithals to avert a liquidity crisis, the Government’s inertia in coming to the rescue is making investors extremely nervous. The Government appears to be bent on slowing down asset price infl ation, and may be “teaching” the more

aggressive banks a lesson for contributing to liquidity supply overfl ow.

BUT EXPECT KLCI TO REMAIN SUPPORTED

• In a survey of economists by Bloomberg immediately after the Fed’s announcement, 44% of the respondents expect the Fed to trim itsmonthly bond purchases to USD65b in September (from USD85b currently) and end the buying completely by June 2014.

• However, the majority of the economists expect the Fed to start raising interest rates only in 2015. On this score, there is still hope for the local market to resume its “secular” uptrend after the current upheavals have settled.

• We note that the KLCI remained well supported last week and stayed above the 50-day moving average (together with FBM70). The strategy now is to switch to quality names and defensive plays.

by MIDF