2012 - A Trader's Market?

Asia ex-Japan

Go contrarian. Investors should buy into oversold cyclicals in the near term and go Overweight on consumer discretionary, IT, industrials and materials. Asia ex-Japan equities are currently trading at very attractive valuations of 10.7x 12-month forward PER and investors’ expectations are low, but cashed up.

Policy inflexion point. Several catalysts will drive the re-rating process; the unofficial quantitative easing by the European Central Bank and policy easing in Asia will stabilise the domestic liquidity situation. In addition, corporate earnings, especially in the industrial sectors, should be supported by better margins and an end to global inventory adjustment by 1Q12.

Prefer China and TIP. That said, the outlook for the full year will continue to be clouded by events in the developed world. Against this backdrop, growth stocks usually outperform value stocks. On a country basis, this translates to an Overweight on China and TIP (Thailand, Indonesia and the Philippines) due to their better EPS growth outlook.

Underweight India and developed Asia. We are funding this out of an Underweight position on Hong Kong, India and Singapore due to their less supportive liquidity cycle. In particular, financials in Hong Kong will be weighed down by the relatively tight global free liquidity, in contrast to the latter’s upswing in 2009.

Despite the positive start to 2012, investors remain sceptical. Perhaps the bitter aftertaste of a disappointing 2011 continues to linger. However, we strongly recommend investors to go long on the market in the near term. We see a mini rally in the offing; what is different compared to last year is that investors are starting this year with very low expectations and the global economy is not as bad as it had seemed. With cash ratio running high, we expect investors to put the funds to work on improving macro news flow as the European Central Bank’s (ECB) unofficial quantitative easing (QE) and policy reversals in Asia make their impact felt.

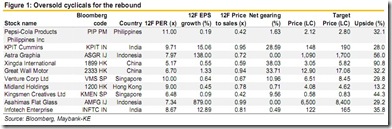

In the near term, we like oversold cyclicals and among the bigger caps, we prefer stocks in the industrials, IT, materials and consumer discretionary sectors.

For the full year, we expect 2012 to remain a trader’s market. The funding needs in Europe and prospects of further fiscal austerity in the developed world will continue to cloud the market outlook. Hence for the medium term, we are overweight on China and TIP (Thailand, Indonesia and the Philippines) on the basis of their stronger EPS growth outlook. At the stock level, investors should focus on those with topline visibility.

by Maybank Investment Bank