FBM KLCI and Malaysia GE14

Last Friday, PM Najib announced the dissolution of Parliament. In the past, polling was held 17-32 days after dissolution. We believe the first weekend of May to be the likely polling date. FBMKLCI ended higher between dissolution to polling in 3/5 past GEs while volatility has always been lower during this period. BN’s manifesto was focused on employment and cost of living with financing of these measures likely to come from higher oil price. Easing cost of living burden was a heavily weighted theme in PH’s manifesto which may increase the budget deficit from 2.8% of GDP to 4%. We expect a status quo political outcome for GE14 premised on heightened 3-corner fights. Our FBMKLCI target of 1,880 is unchanged based on 16.5x P/E on 2018 earnings (7.8% YoY growth).

Parliament dissolved. Last Friday, Prime Minister Najib Tun Razak (PM Najib) announced the dissolution of Parliament, paving way for the 14 th General Elections (GE14). The polls must be held within 2 months of Parliament dissolution for Peninsular and 3 months for Sabah and Sarawak. In the past 5 GEs, polling was held between 17-32 days after dissolution. Applying this similar timeline implies that polling for GE14 could take place between 23-April to 8-May. We are inclined to believe that the first weekend of May (either 5 th or 6 th ) is a likely scenario.

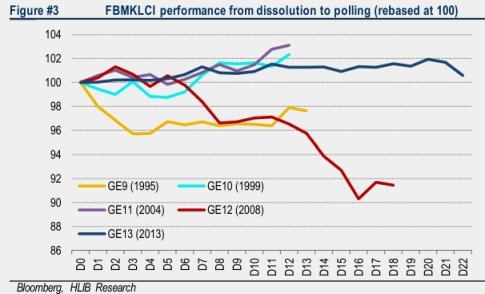

Market behaviour. Analysis of the past 5 GEs indicates that the FBMKLCI ended higher in 1999, 2004 and 2013 but lower in 1995 and 2008 (see Figure #3). Interestingly, volatility of the FBMKLCI (measured as the standard deviation of daily returns) was lower between dissolution to polling (at 0.47-0.83x) when compared to the full year. This could possibly be due to investors staying out of the market during this period of perceived heightened political risk.

Expect a status quo. We expect GE14 to result in a status quo outcome, i.e. Barisan Nasional (BN) to remain in government. Our view is anchored by the inevitable increase in 3-cornered fights for GE14 as PAS is no longer with the larger opposition coalition, i.e. Pakatan Harapan (PH). Historically, 3 corner fights have tilted the balance towards BN’s favour. We anecdotally support this with 2 points: (i) the 2016 Kuala Kangsar and Sg Besar by-elections saw BN winning in 3-cornered fights and (ii) in the past 5 GEs, BN’s biggest victory occurred when opposition parties were fragmented in 1995 (BN won 84% of the seats) and in 2004 (90%).

BN unveils manifesto. Last Sat, BN unveiled its manifesto with 14 major points (see Figure #6) with a focus on employment (jobs creation and enhancing employability), cost of living (affordable housing, BR1M enhancement and higher minimum wage). As most of the promises will be implemented over 5 years, there should be no significant impact to our 2018 economic headline projections (GDP: 5.3%, inflation: 2,7% and OPR: no further hike for the year). We believe that most of the incremental cost this year from the proposed manifesto measures can be somewhat offset by higher oil revenue. YTD oil price has averaged USD67.2/barrel vs MoF assumption of USD52/barrel. We estimate that every USD1 increment would add RM300m to the government’s coffers.

Recapping PH’s manifesto. In early Mar, PH launched its manifesto with its pledges largely focused on easing cost of living burdens (see Figure #8). We estimate that its proposed GST abolishment would cause a loss of RM43.8bn in government revenue. This would be partially offset by the reintroduction of sales tax (RM9.5bn). PH plans to further fill this “GST gap” by eliminating leakages, wastage and corruption which it estimates at RM15-20bn. Under this scenario, we estimate (albeit simplistically) that Malaysia’s 2018 budget deficit target of RM39.8bn (2.8% of GDP) would increase to RM56.6bn (4.0% of GDP).

Maintain FBMKLCI target. We retain our FBMKLCI earnings growth forecast of 7.8% for 2018, which is pretty much inline with our GDP (5.3%) + inflation (2.7%) target of 8%. Our unchanged FBMKLCI target of 1,880 is based on 16.5x P/E tagged to 2018 earnings. We believe that investor risk appetite and foreign inflows will return to Malaysian equities post GE14 once the perception of political risk dissipates. A full blown US-China trade war would be the key risk to our positive view.

source: HLIB Research – 09/04/2018