Malaysian Property Outlook

Feedback from marketing

■ Most funds we met during our property roadshow last week remained underweight on the property stocks in their portfolios.

■ However, we sensed that overall investor sentiment about property stocks had improved compared with a few months ago.

■ Maintain Overweight on the sector as we expect a recovery in property sales in 2H16 to rekindle investor interest in property stocks. Eco World is our top pick

■ Most funds we met during our property roadshow last week remained underweight on the property stocks in their portfolios.

■ However, we sensed that overall investor sentiment about property stocks had improved compared with a few months ago.

■ Maintain Overweight on the sector as we expect a recovery in property sales in 2H16 to rekindle investor interest in property stocks. Eco World is our top pick

Two-day marketing in KL

● We spent last Thursday and Friday marketing the Malaysia property sector in Kuala Lumpur to about 20 fund managers and analysts. Most funds still underweight property stocks in their portfolios but we sensed that sentiment on the sector had improved compared with during our roadshow in late-Mar 2016, when there were grave concerns about the perceived oversupply of properties and the decline in housing affordability for the general public. Investor perception about property has improved

● The investors we met this time were less concerned about the risk of a property bubble than they were previously. Some even believed that the worst may have passed. The strong take-up rates (Fig 1 for examples) at recent launches certainly improved investor perception about the demand for properties and eased concerns about speculators’ fire sales affecting property sales in the primary market. More strong take-ups could attract more investors to property

● We expect developers to launch more mass market properties in the coming months.Those under our coverage have lined up a series of properties and they are sticking to their launch targets. A majority of these properties target the mass market and we expect them to achieve good take-up due to the undersupply of mass market properties in the past few years. Strong take-ups could further improve investor sentiment about property stocks.

High-yielding property stocks are preferred

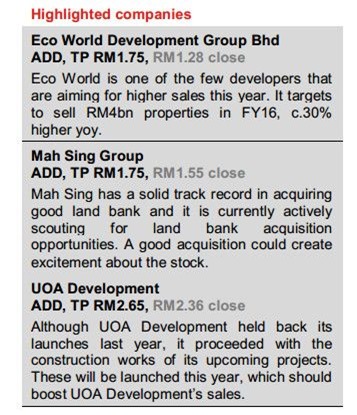

● Still, investors are underweighting property stocks for now due to the absence of a strong catalyst for property sales in the near term. For investors who are concerned about falling into a value trap but want exposure in property, we recommend stocks with decent dividend yields and strong management as they offer stable returns as well as share price upside when the recovery in demand for physical properties gains strength. These stocks include LBS Bina, Mah Sing, and UOA Dev.

● We spent last Thursday and Friday marketing the Malaysia property sector in Kuala Lumpur to about 20 fund managers and analysts. Most funds still underweight property stocks in their portfolios but we sensed that sentiment on the sector had improved compared with during our roadshow in late-Mar 2016, when there were grave concerns about the perceived oversupply of properties and the decline in housing affordability for the general public. Investor perception about property has improved

● The investors we met this time were less concerned about the risk of a property bubble than they were previously. Some even believed that the worst may have passed. The strong take-up rates (Fig 1 for examples) at recent launches certainly improved investor perception about the demand for properties and eased concerns about speculators’ fire sales affecting property sales in the primary market. More strong take-ups could attract more investors to property

● We expect developers to launch more mass market properties in the coming months.Those under our coverage have lined up a series of properties and they are sticking to their launch targets. A majority of these properties target the mass market and we expect them to achieve good take-up due to the undersupply of mass market properties in the past few years. Strong take-ups could further improve investor sentiment about property stocks.

High-yielding property stocks are preferred

● Still, investors are underweighting property stocks for now due to the absence of a strong catalyst for property sales in the near term. For investors who are concerned about falling into a value trap but want exposure in property, we recommend stocks with decent dividend yields and strong management as they offer stable returns as well as share price upside when the recovery in demand for physical properties gains strength. These stocks include LBS Bina, Mah Sing, and UOA Dev.

Maintain Overweight

● Although Eco World’s prospective dividend yield is less than 1%, it remains our top sector’s pick. We believe Eco World offers the highest share price upside as it is the most leveraged, financially and operationally, among the developers that we cover. A recovery in property sales in 2H16, driven by improving homebuyer confidence and more launches of mass market properties, could trigger a re-rating in property stocks’

prices. A sudden economic shock is the key downside risk to our sector call.

● Although Eco World’s prospective dividend yield is less than 1%, it remains our top sector’s pick. We believe Eco World offers the highest share price upside as it is the most leveraged, financially and operationally, among the developers that we cover. A recovery in property sales in 2H16, driven by improving homebuyer confidence and more launches of mass market properties, could trigger a re-rating in property stocks’

prices. A sudden economic shock is the key downside risk to our sector call.

source: CIMB Research 25/07/16