Bursa Malaysia April Fund Flow

Current KLCI: 1,860 (5 May) YE KLCI target: 1,940 (unchanged)

April fund flows

* Foreigners turned net buyers in April, but small, vs. more aggressive net buying in the other Emerging ASEAN markets. KLCI valuations sustained at rather high 16.0x 12M forward earnings and almost 2x PEG.

* We maintain our end-2014 KLCI target of 1,940 and sector weights; we also remain selective on stocks.

What’s New

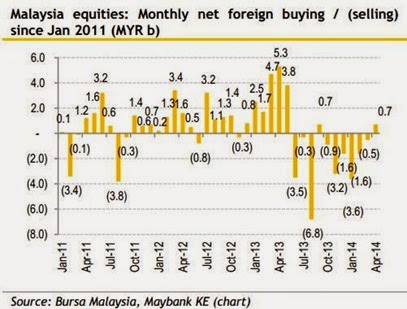

Foreigners, who have been net buyers of Malaysian equities sincethe last week of March, stayed on as net buyers in the month of April, totaling MYR0.7b (March: MYR0.5b net sell).

Compared to buying prior to the sell-down in Jun 2013, the MYR0.7b foreign net buying in April was small. It was also small

compared to more aggressive foreign net buying in the other Emerging ASEAN markets, namely , Indonesia, Thailand and Philippines. Net foreign buying in each of these markets was easily more than double that of Malaysia.

April’s foreign net buying essentially pared down the foreign net sell position for the YTD (Jan-Apr) to MYR5.0b (2013: MYR2.4b net buy). We estimate that foreign shareholding in Malaysian equities was stable at the 23% level at end-April (end-March: 23.0%).

What’s Our View

The KLCI gained another 22.3 pts (+1.2% MoM) in April, after rising 13.6 pts (+0.7% MoM) in March. For the 4M YTD, the KLCI was up 0.2%, but it still lagged its peers. Much of this was due to the KLCI’s outperformance in 2013 (+10.5%) which sustained valuations at rather high 16.0x 12M forward earnings and almost 2x PEG.

There is no change to our end-2014 KLCI target of 1,940 pegged to 15.8x 12M forward earnings (+0.5SD of mean). We do not expect

major surprises in the current 1Q14 results reporting season which will conclude end of this month; we forecast 8.1% core earnings growth for the KLCI and 11.5% for our research universe.

We continue to Overweight construction, and oil & gas with nearterm catalysts being contract flows to sustain the earnings momentum. We also Overweight power expecting TNB’s valuation gap to the KLCI to narrrow. Beyond these, catalysts and thematics are lacking. On the macro front, continuing subsidy rationalisation and an anticipated rise in the benchmark overnight policy rate by this year-end will continue to dampen consumer sentiment.

We remain selective on stocks; our top picks are TNB, GENM, HL

Bank, AMMB, Bumi Armada, IJM Corp and MPHB Cap.

by Maybank IB