Malaysia Banking Stocks Outlook

Pick up in deposits growth

• Strong loans growth continued

Loan base grew 9.8% y-o-y and 0.5% m-o-m in March 2010 to

RM805.9bn. YTD, loans growth is at 2.9%. On an annualised basis, loans have grown by 11.4% YTD, which is higher than our expectation of 8% to 10% growth for CY2010. Loans growth continued to be driven by household sector which account for 62.8% of YTD growth. Loans to household sector expanded 3.3% YTD as compared to loans to the business segment which grew by 2.4% YTD. The continued strong household loans expansion is mainly due to loans extended for the purchase of residential property which expanded 2.8% YTD.

Lending indicators all point towards further loans expansion in the coming months. Loans application, approval and disbursement in March 2010 have increased by 23.0%, 12.6% and 11.4% y-o-y respectively.

• Deposits grew faster than loans in March 2010

Although deposits grew strongly by 1.9% m-o-m to RM1,068.8bn, its y-o-y growth of 8.4% still lack behind that of growth in loan base. As such, loan-deposit ratio has increased to 79.2% (Mar 09: 73.7%, Feb 10: 79.7%) and financing-deposit ratio has increased to 85.5% (Mar 09: 80.8%, Feb 10: 86.2%) on y-o-y basis.

• Net NPL declined further Net NPL ratio has declined further to 1.83% (Feb 2010: 1.91%, Mar 2009: 2.24%) while loan loss coverage has improved to 95.9% (Feb 2010: 94.0%, Mar 2009: 88.3%).

• Capital ratios declined marginally, but remains healthy RWCR and core capital ratio have declined marginally to 14.9% (Feb 2010: 15.1%) and 13.2% (Feb 2010: 13.5%) respectively. This is not surprising as loan expansions resulted in risk-weighted assets growing faster than capital base. Nevertheless, the Malaysian banking system remains well capitalised.

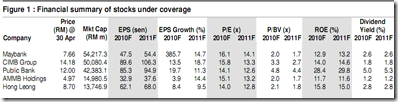

• Maintain OVERWEIGHT

We expect credit expansion, return of capital market transactions, interest rate expansion and slide in credit costs to drive earnings growth in 2010. We like CIMB Group Holdings for its regional as well as its strong non-interest income growth going forward. Public Bank continues to be an investment for its superior earnings, ROE and asset quality, while we believe Maybank will finally allay sceptics’ concerns when it continues reporting strong quarterly profits going forward.

click the above table for larger viewing.

by: ECM Libra