GAMUDA: SPLASH Selangor water assets offer Commnentary

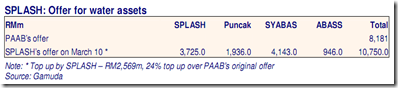

Gamuda’s associated company, SPLASH, has made a joint bid with the federal government for Selangor water assets. SPLASH will ‘top up’ an additional RM2.6b on top of the federal government’s earlier offer of RM8.2b. Gamuda said the re-aligned offer will meet the spirit of the Water Services Industry Act (WASIA) and the federal government’s policy for operators to be ‘asset light’. To recap, SPLASH had earlier offered to pay the offer price on its own.

Upon the takeover, federal government will own and carry all water assets on its book and lease the assets to SPLASH to let it be the O&M operator under a 30-year concession. SPLASH will pay the government lease rentals of 6% p.a. with an annual escalation of 2.5%, the same rate as charged by government to the operating entities in other states.

Comment:

Main obstacle is still the Puncak Group. The total offer price of RM10.8b to all state water asset owners is still unchanged. We think the offer price is likely to be rejected by the Puncak Group as we understand that it finds the offer price of RM6.1b (for the assets of Puncak Niaga and Syabas) unattractive.

Expect cash outlay should the deal be accepted. We estimate Gamuda’s cash flow gain at RM400m assuming RM500m out of RM750m compensation to SPLASH’s O&M operators goes to its 80% stake in Gamuda Water. However, SPLASH also has to fork out RM2.6b for the deal. Assuming 100% equity funding, Gamuda is required to inject RM1b into SPLASH (RM2.6b x 40% stake). Over the long term, we believe the water operating services will generate steady cash flow to the Group.

Maintain BUY and RM3.30 target price. Our sum-of-the-part target price of RM3.30/share implies FY11F PE of 18x, which is below its upcycle PE of 23x.

source: by UOBKayHian