Astro - according to MIDF

Astro All Asia Networks plc

Upgrade to Trading Buy

Revised Target Price (TP): RM4.30 (from RM3.30)

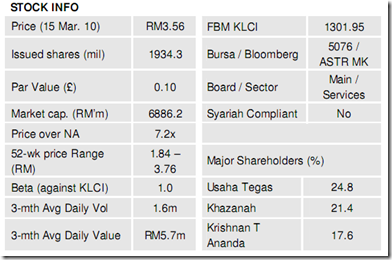

• After years of speculation by the media and denial by the company’s officials, Astro will finally be taken private by its two major shareholders, Usaha Tegas and Khazanah Nasional in all cash offer of RM4.30 per share. The offer price seems reasonable as it is 21% above its last traded price of RM3.56 and its IPO price of RM3.65.

• The privatisation exercise will allow Astro’s major shareholders to chart its growth path free from minority shareholders’ scrutiny as well expectation in terms of medium-term investment returns. It is highly likely that with plans of regional expansion into China and India, capital outlay will be great and strong operational cashflow generated from domestic operations will be channelled toward this ambition. We do not rule out the possibility of the entry of a strategic shareholder post privatisation (a la Maxis), which will facilitate its expansion into China and India.

• Going forward, earnings growth prospects from its operations are bright sans losses from its Indonesian joint venture, which is it incurred in FY09. However, if Astro were to expand into regional markets in a big way, earnings will likely be adversely affected. Hence, the rationale for the privatisation (again, akin to Maxis’ privatisation). With the takeover offer, we revise upwards our recommendation to Trading Buy with an upgraded target price of RM4.30. At the offer price, Astro is valued at RM8.3b or 10.7x EV/ EBITDA and trades at 31.4x EPS10 and 25x EPS11.

To be privatised by its major shareholders: Astro All Asia Networks plc has received a buyout proposal of RM4.30 per share in an all cash offer by its major shareholders, Usaha Tegas and Khazanah Nasional. A special purpose vehicle will acquire the balance 27.1% of Astro from public shareholders.

At all cash offer price of RM4.30: The offer price seems reasonable as it is at a 21% premium to its last traded price of RM3.56 and its IPO price of RM3.65. At RM4.30, Astro is valued at RM8.3b or 10.7x EV/ EBITDA and trades at 31.4x EPS10 and 25x EPS11.

Regional expansion plans and huge capital outlay; long gestation period for minority shareholders: The privatisation exercise will allow Astro’s major shareholders to chart its growth path free from minority shareholders’ scrutiny as well expectation in terms of investment returns. It is highly likely that with plans of regional expansion into China and India, capital outlay will be great and strong operational cashflow generated from domestic operations will be channelled toward this ambition. We do not rule out the possibility of the entry of a strategic shareholder post privatisation (a la Maxis), which will facilitate its expansion into China and India. Astro is expected to spend as much as RM3.5b on capital expenditure over the next few years for its domestic and overseas businesses.

Commendable share price performance: Astro’s share price has risen by 18.7% year-to-date and 91.1% on a one-year total returns basis. Despite the outperformance in recent period, its share price has traded below its IPO price of

RM3.65 since Jun08.

Earnings growth prospects paltry with an estimated single-digit revenue growth for FYJan10: In the absence of any negative surprises, we expect Astro to be profitable in FYJan10. We forecast revenue growth of 5.7%yoy backed by expanding subscriber base and stable ARPU. Astro has 2.875m subscribers and this is a 47.6% market share of TV-viewing households and plans to raise the figure to 60% by 2012.

Upgrade to trading buy with a target price of RM4.30: With the privatisation offer, we revise upwards our recommendation to Trading Buy with an upgraded target price of RM4.30. At the offer price, Astro is valued at RM8.3b or 10.7x EV/ EBITDA and trades at 31.4x EPS10 and 25x EPS11.

source: MIDF research